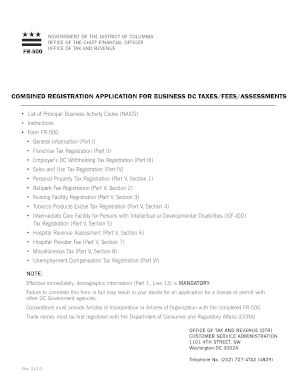

DC FR-500 2015-2025 free printable template

Show details

Enter the correct Business Activity Code from the list of codes pro vided. The identification number s entered on the Form FR-500 will be used only for tax administration purposes. Sign the application at the end of Part IX. Corporations must provide Articles of Incorporation or Articles of Organization with the completed application directly to OTR. If you complete the FR-500 online mail the Articles to the address listed on the front cover. If you are requesting exemption from income and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fr 500 form

Edit your fr500 dc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fr 500 dc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dc form fr 500 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form fr 500 dc. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DC FR-500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form fr 500

How to fill out DC FR-500

01

Obtain a copy of the DC FR-500 form from the official website or local tax office.

02

Fill in your business name and address in the designated sections.

03

Provide your federal employer identification number (FEIN) if applicable.

04

Indicate the type of business entity you are operating.

05

Complete the sections regarding gross receipts or sales from the previous year.

06

Calculate and fill in the estimated tax amount owed based on the given instructions.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate tax authority by the deadline.

Who needs DC FR-500?

01

Businesses operating in the District of Columbia.

02

Individuals who have gross sales or receipts above a certain threshold.

03

Any entity required to report and pay the franchise tax or business income tax.

Fill

fr500 form dc

: Try Risk Free

People Also Ask about fr 500 washington dc

How do I get a DC withholding number?

District of Columbia Withholding Account Number If you're unsure, contact the agency at 202-727-4829.

Is there a DC nonresident tax return?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

Do I need to file DC corporate tax return?

Corporations that carry on or engage in a business or trade in D.C. or otherwise receive income from sources within D.C. must file Form D-20 with the D.C. Office of Tax and Revenue. The minimum payable tax is $250 if gross D.C. receipts are $1 million or less; $1,000 if they exceed $1 million.

What is DC Form FR-500?

FR-500 New Business Registration (new registrations only)

What is the benefit of the pass-through entity tax?

One of the main tax benefits of electing a pass-through business structure is avoiding double taxation. Business earnings are only taxed once, on the owner or shareholder's personal tax return.

What is the DC pass through entity tax credit?

D.C. allows the resident individual to claim a credit against such resident's D.C. income tax liability for the PTE tax paid on such resident's behalf to other state in the same manner as if these taxes were paid by the individual directly.

What is my DC withholding tax ID number?

You can find your Withholding Tax Account Number on notices received from the DC Office of Tax and Revenue. If you cannot locate this document or account number, please call the District of Columbia Office of Tax and Revenue at (202) 727-4829 to request it.

What is a pass-through tax credit?

What Is the Pass-Through Business Deduction (Sec. 199A Deduction)? The Tax Cuts and Jobs Act created a deduction for households with income from sole proprietorships, partnerships, and S corporations, which allows taxpayers to exclude up to 20 percent of their pass-through business income from federal income tax.

What is FR 500 in DC?

Tax Registration (FR-500)

What is my DC withholding account number?

You can find your Withholding Tax Account Number on notices received from the DC Office of Tax and Revenue. If you cannot locate this document or account number, please call the District of Columbia Office of Tax and Revenue at (202) 727-4829 to request it.

What is the standard deduction for DC?

Standard Deduction: The standard deduction has increased for Tax Year 2022 as follows: From $12,550 to $12,950 for single and married/registered domestic partner filers filing separately. From $18,800 to $19,400 for head of household filers.

How long does it take to get a DC withholding tax number?

Register online at the OTR's Combined Registration Application to receive the number within 3-5 business days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fr 500 new business registration form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing dc form fr500, you can start right away.

Can I edit dc fr 500 fillable pdf on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fr 500 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete fr 500 dc form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your dc fr 500 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is DC FR-500?

DC FR-500 is a tax form used in the District of Columbia for businesses to report their sales and use taxes.

Who is required to file DC FR-500?

Any business operating in the District of Columbia that makes sales of tangible personal property or provides taxable services is required to file DC FR-500.

How to fill out DC FR-500?

To fill out DC FR-500, businesses must provide their identifying information, report total sales, calculate the taxes owed, and ensure they provide accurate figures for each taxable category.

What is the purpose of DC FR-500?

The purpose of DC FR-500 is to accurately report and remit the sales and use taxes collected by businesses to the District of Columbia government.

What information must be reported on DC FR-500?

DC FR-500 requires businesses to report their total sales, any exempt sales, the amount of tax collected, and details of any deductions or credits claimed.

Fill out your DC FR-500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fr 500 New Business Registration is not the form you're looking for?Search for another form here.

Keywords relevant to fr500

Related to fr500 dc tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.